FORUS Digital Overview

The future of digital money

Digital Transformation in Africa.

The time for action is now.

In the realm of digital development, Africa must dream big. The current gradual pace of economic and social progress risks limiting the potential of our burgeoning youth population. However, digital technologies present an unprecedented opportunity to disrupt this trajectory, opening new avenues for rapid economic growth, innovation, job creation, and access to services that were once unimaginable a mere decade ago. Despite these prospects, there is a widening ‘digital divide’ and an increase in cyber risks that demand urgent and coordinated action.

Africa offers a vast array of economic opportunities across various sectors, with its youthful population standing as a powerful asset in this digital age. Therefore, making digitally enabled socio-economic development a top priority is imperative. Digital transformation serves as a catalyst for innovative, inclusive, and sustainable growth. Innovations and digitalization not only stimulate job creation but also play a pivotal role in poverty alleviation, reducing inequality, enabling efficient delivery of goods and services, and contributing significantly to the realization of Agenda 2063 and the Sustainable Development Goals.

FORUS

Pronunciation: / For. Us / (Because it is!)

Noun [ C or S ]

>

The Acronym

- FREE

- OPEN

- REALTIME

- UBIQUITOUS

- SECURE

FREE

Free digital cash exchange

The exchange of cash is free of charges. The digital equivalent on your mobile wallet has to be free too, else digital cash cannot compete with cash.

OPEN

Intergration possibilities

Open architecture allows for any system to be integrated leading to new opportunities in digital transformation for everybody.

REALTIME

Seamless transaction

No delay, no reconciliations, no risk of chargeback. No need for a middleman, that cost money. Reduced admin, error free reporting.

UBIQUITOUS

Interoperable Payment Systems

For an interoperable payment system to work, everybody has to adopt it at scale. FORUS is the network of networks that brings everybody together.

SECURE

Ensuring Integrity

Identity Verification, Secure S-QR codes, two factor authentication and blockchain ensures the platform’s integrity and that it remains secure.

Recipe for Economic Freedom

The future of digital money

1. Replace cash with digital money

This creates Inclusive Digital Money and new opportunities

2. Digital Transformation Toolkit

All the tools needed to do business and accelerate Business growth.

3. Shared Platform Revenue

A cashless digital economy creates new sources of revenue that are shared using smart contracts.

4. Community owned projects

People list their projects for investment on the FORUS Digital exchange and the community invests at scale.

5. Wealth fund

Institutions invest in de-risked projects using a waterfall bond structure, where the community has taken first risk on their own projects.

6. Autonomy

Your community, your rules. Open, transparent governance for the people by the people, building a foundation of trust that is investable.

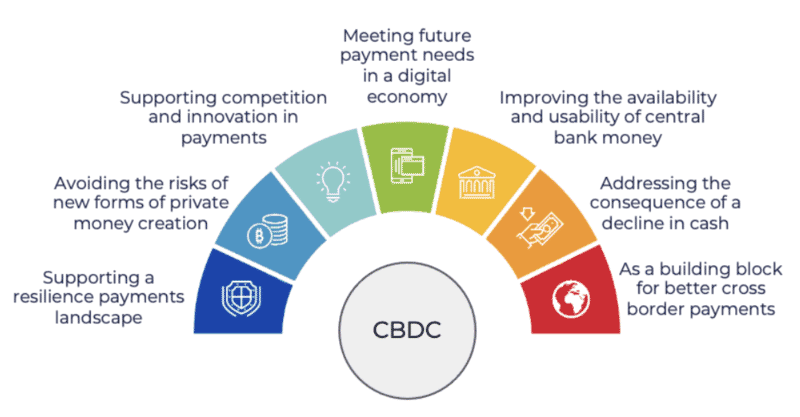

CBDC's

Cental Bank Digital Currencies

60 countries are in an advanced phase of exploration (development, pilot and launch)

A Central Bank Digital Currency (CBDC) is virtual money backed and issued by a central bank. As cryptocurrencies and stablecoins have become more popular, the world’s central banks have realised that they need to provide an alternative or let the future of money pass them by.

Testing

14 countries, representing over 95 percent of global GDP, are exploring a CBDC.

Launched

11 countries have fully launched a CBDC used by 250 million people on a daily basis.

The Challenge.

Cash Dominance in The developing world

In many parts of The developing world, cash remains the dominant form of transaction, presenting multifaceted challenges to both individuals and economies:

Security Risks

Carrying and storing large amounts of cash can lead to significant security risks, making individuals vulnerable to theft and criminal activities. Additionally, businesses face challenges in safeguarding their revenues, often investing in costly security measures to protect their assets.

Cross-Border Transactions.

Traditional cash transactions across borders are costly and slow due to currency conversions, fees, and delays, restricting regional economic growth and trade.

Economic Growth Limitations

Cash-based economies hinder growth as informal transactions complicate economic tracking, creating challenges in taxation, budgeting, and essential public service allocation for governments.

The Solution.

Enhanced Security

By transitioning from physical cash to digital transactions, individuals and businesses gain enhanced security. FORUS Digital employs state-of-the-art encryption and authentication measures, ensuring safe and secure financial transactions, even in remote areas.

Effortless Cross-Border Transactions.

FORUS Digital facilitates effortless cross-border transactions, eliminating the hurdles associated with currency conversions and high transaction fees. Through the use of Central Bank Digital Currencies (CBDC) and stablecoins, our platform enables instant and cost- effective international transactions, promoting regional economic integration and trade growth.

Empowering Growth

Investment Opportunity

FORUS Digital invites early investors to participate in our groundbreaking financial digitization strategy in The developing world. By investing in FORUS Digital, you will contribute to the immediate earnings, further acquisitions, and expansion of our platform throughout the continent.

Why FORUS?

Our proven revenue model ensures lucrative returns on your investment. As we usher in the future of digital finance in the developing world, early investors stand to gain from the platform’s rapid growth and widespread adoption.

> Meaningful Stake

By investing in FORUS Digital, you aren’t just a shareholder; you’re a vital participant in our mission. Your contribution directly fuels immediate earnings, paving the way for further acquisitions and the expansion of our transformative platform across the continent.

> Contributing to Transformation

Your investment drives digital transformation, fostering inclusion and economic growth. Each investment propels a more prosperous future.

> Listed Company Status

FORUS Digital is targeting the acquisition of a member of the Johannesburg Stock Exchange. This vehicle will provide transparency, credibility, and stability to your investment. Our commitment to ethical practices and financial excellence underpins your investment’s security.

> Strategic Expansion

Early investments power acquisitions, tech enhancements, and market reach, turning FORUS Digital’s vision into transformative reality.

In-Country Operations

In FORUS’ in-country operations, we unite central banks, network operators, commercial banks, companies, co-operatives, and platform users in a collaborative effort. Together, we drive digital financial inclusion, empowering unbanked populations and fostering economic growth. Our collective commitment creates a transparent and efficient ecosystem, benefitting individuals, businesses, and governments alike.

In-Country Platforms & Interoperability

We plan to establish In-Country Platforms in collaboration with local partners, adhering to each country’s regulations.

These platforms, operated as joint ventures, will ensure complete interoperability once agreements and regulations between participating countries are in place. This approach ensures localized customization while maintaining a global network.

Securing the Open Standard

FORUS Digital presents S-QR, your ticket to secure and seamless digital interactions. Our innovative QR code solution, powered by unique SHA-2 cryptographic hashes and digital signatures, guarantees data authenticity and prevents tampering. More than just secure scans, S-QR is the key to interoperability between platforms and users. Explore the digital world with confidence, knowing you’re on a protected pathway. Revolutionizing security, enhancing connectivity – that’s S-QR by FORUS Digital.

Digital ID

Ensuring Network Integrity

Customer can verify themselves remotely at any time that suits them on any device – smartphone, laptop or tablet.

No need to rely on having the latest mobile number or device ID for the customer on record.

Contactless biometrics for individuals who are not comfortable placing their fingerprint on a fingerprint scanner.

Combined ID and payment card

Passwordless login

Full audit trail of all customer enrolments and verifications in a secure data vault.

Over 4500 ID’s world-wide

Includes liveness detection and anti-spoofing

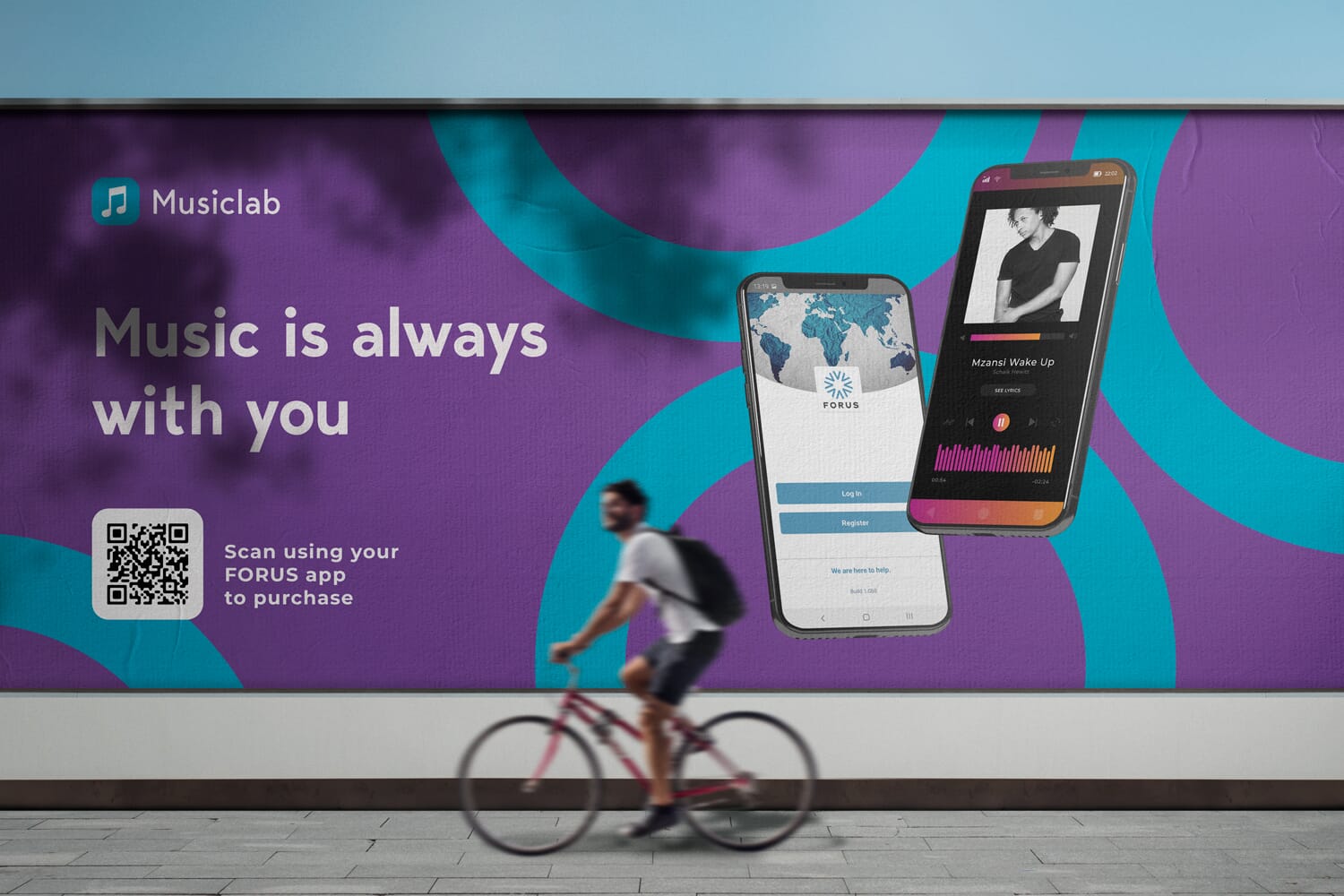

Monetisation of Social Media and Digital Content

Secure one-click checkout on all channels

Use the FORUS Digital Vendor App to create S-QR Tags, place them anywhere and directly sell product securely over any media.

Ecentric Payments Systems

With over twenty- four years of payment processing experience, our partners Ecentric Payment Systems provides payment services to Africa’s largest retailers.

- Linked over 100,000 tills across South Africa | Namibia, Zambia, Botswana, Lesotho and Swaziland.

- Ecentric powers leading payment brands and initiatives such as SnapScan / sixty60 and Thumzup

Ecentric, our chosen transaction powerhouse, will play a pivotal role in energizing all FORUS transactions. Through seamless integration into our system, FORUS gains universal acceptance, becoming a ubiquitous presence across diverse platforms and locations. This integration ensures that FORUS transactions are not only universally recognised but also effortlessly accessible everywhere, all at once. By harnessing the capabilities of Ecentric, we aim to create a seamless and widely accepted financial ecosystem, providing users with unparalleled convenience and accessibility in their financial interactions

New Sources of Revenue

FORUS Digital introduces a robust revenue strategy designed to drive sustainable growth and foster financial empowerment. Anchored by a one-time membership fee, our platform ensures seamless access for users to the comprehensive FORUS Digital experience. The incorporation of microfinance initiatives, Hyperlocal eCommerce transactions, collaborations with network operators, and innovative Adverbuying models amplifies our potential for creating a dynamic, revenue-generating ecosystem. These strategic pillars set the foundation for our commitment to financial inclusion, innovation, and the overall success of FORUS Digital.

> Working capital finance

Recouped as a percentage on sales, typically 3%: 1% accrues to the platform, 1% to investors and 1% to the bank that administers the fund.

> Adverbuying

A variant of advertising, where highly targeted promotions are sent to the consumer, where the advertiser only pays for a successful purchase.

> Membership Fee

Once off membership fee for all users to the FORUS Digital Platform – Pay once and done basis.

> Micro finance

Commission on micro financial products offered by authorised financial institutions on the typically 30%, paid by the financial institution.

> Ecommerce

Commission on FORUS Hyperlocal eCommerce platform, typically 3% of transaction value. No transaction fees.

> Mobile Voice and Data

Commission on mobile voice and data sales and other value added services, typically 3%, paid by the network operator.

Thank You

Creating a sustainable and ethical society where capital understands that creativity, people and the planet are the only things that count.

Please feel free to leave us any feedback below. Your input is valued. These documents are ever evolving as we progress through building this platform, for the people, by the people.